Market options and routes

Note: As part of the recruitment process for trail participants; TRANSITION developed extensive resources, explaining key concepts of flexibility markets to a wide ranging audience. Our plain English explanations are a great resource for those interested in replicating our trials.

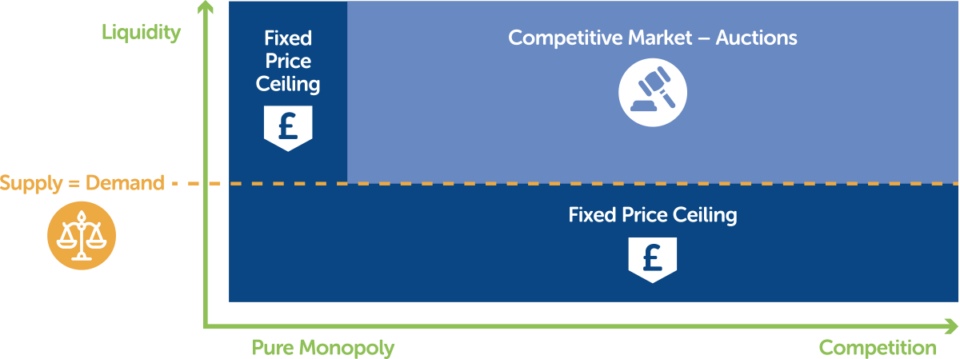

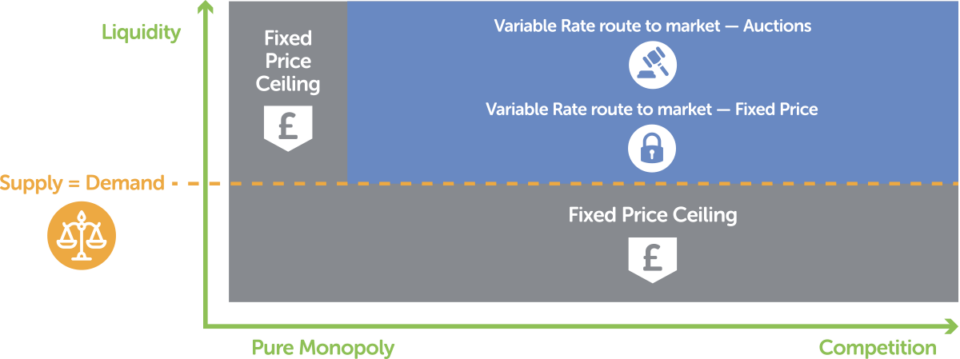

Uncompetitive/Without Liquidity Markets

Markets which are deemed uncompetitive or without liquidity will be offered a price ceiling to participate in a flexibility contract. This is illustrated in the diagram below.

You can download a calculator to help you decided how you would want to apportion your bid into availability (a commitment to deliver energy) and utilisation (energy delivery) payment and to understand the value of your flexibility.

Total Contract Value Calculator with Guidance July 22

Competitive/Liquid Markets

Markets which are deemed competitive i.e. have more than one entrant and offer a supply of flexibility (measured in Megawatts (MW)) greater than the DNO’s demand for flexibility, will be run through competition. As shown below, the competitive market will offer two options: auctions or a fixed price contract.

Auctions will require participants to submit competing bids and offers and SSEN selecting the lowest cost solutions to deliver its constraint.

A fixed price contract will offer the average price at which auctions settle at minus a degree of risk which TRANSITION absorbs by taking this approach.

The fixed price initially offered within competitive markets will be £200/MWh. Competitive auctions may settle above or below this price.

The third route option is through one of our Market Stimulation Packages. They will offer simplicity and financial support to help assets enter the market. They may pay less than the market options presented above. Market Stimulation Packages will no longer be available as the project has entered trail period 3.

The different routes to market acknowledge people are comfortable taking different levels of financial risk and intend to allow you to choose a package that involves the level of risk you are confident with.

Calculating your options and bid price

We can help you to understand the different options so you can make the choice that is right for you.

We also have a ‘Contract Value Calculator’ you can use to calculate the total contract value of any planned offer/response to a request for flexibility. This will help you to ensure you do not exceed the total contract value price ceiling for any flexibility service.